The National Assembly Finance Committee has recommended the deletion of a controversial clause in the 2025 Finance Bill that sought to grant the Kenya Revenue Authority (KRA) broad powers to access taxpayers’ personal and financial data.

Clause 52 of the proposed Bill would have repealed Section 59A(1B) of the Tax Procedures Act, effectively removing legal protections that currently bar KRA from compelling businesses to share sensitive customer information, including mobile money and bank transactions.

In its report tabled in Parliament, the committee—chaired by Molo MP Kuria Kimani—said the clause fails to meet constitutional thresholds set under Article 31(c) and (d), which guarantee the right to privacy.

“The committee also referenced Section 51 of the Data Protection Act, which outlines the specific conditions under which exemptions to data protection may be permitted,” the report states.

It further noted that KRA already has avenues to access financial data through existing legal frameworks, including applying for judicial warrants.

“This ensures that tax enforcement powers are exercised within a framework of legal oversight and due process,” the MPs noted. “Protecting personal privacy and adhering to judicial oversight not only reinforces public trust but also aligns Kenya’s approach with international best practices in data protection.”

The proposal had drawn sharp criticism from several stakeholders, including the Law Society of Kenya and KPMG East Africa, who submitted memoranda warning that it would amount to surveillance overreach and expose personal data to potential abuse.

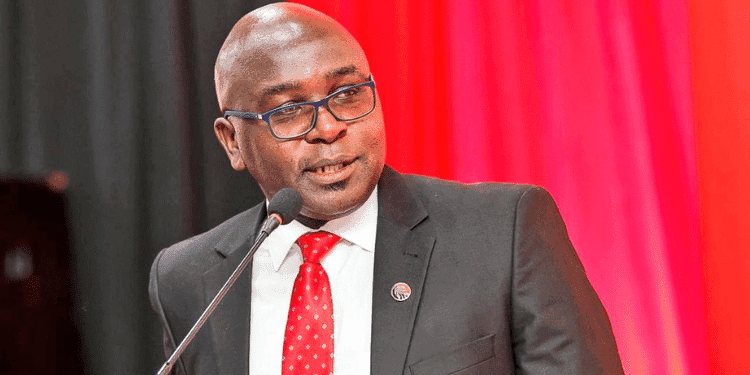

Despite the backlash, Treasury Cabinet Secretary John Mbadi had defended the proposal, citing Kenya’s persistent challenge with tax compliance. “People love convenience, especially where money is involved. If you just let Kenyans pay taxes at will without being followed up, they will not,” Mbadi said in a recent TV interview.

KRA Chairperson Ndiritu Muriithi had echoed similar sentiments, arguing that the provision would help seal tax evasion loopholes and broaden the country’s tax base. He revealed that out of 20 million registered taxpayers, only 10 million file returns, with six million of those being nil returns.

However, the committee’s recommendation now sets the stage for Parliament to reject the clause in its entirety as the Finance Bill 2025 moves into debate and potential amendments.