Kenyans can now file their Nil tax returns via the eCitizen platform, the Kenya Revenue Authority (KRA) has announced, marking a major shift aimed at easing tax compliance ahead of the June 30 deadline.

In a statement released Thursday, KRA confirmed the rollout of Nil return filing services on eCitizen as part of a wider effort to simplify and modernise tax collection in Kenya.

“You can now file NIL returns on eCitizen; filing taxes has never been this easy. Use this and escape the commotion,” the authority said.

Previously, all tax filing—including Nil returns—was exclusively conducted via iTax, KRA’s long-standing digital tax portal. However, with frequent system downtimes and complaints over usability, the authority has now begun integrating services into eCitizen, the country’s centralised government services platform.

How to File Nil Returns on eCitizen

- Visit the eCitizen portal and log in using your normal credentials.

- Select the KRA services tab.

- Navigate to the tax filing section.

- Choose Nil returns if you had no taxable income for the financial year.

- Confirm that your KRA PIN and personal details are correct.

- Click submit, and a confirmation message will appear on the screen.

KRA has assured users that the system is secure, and all records will be automatically updated once submission is complete.

This move is part of KRA’s broader digital transformation agenda to boost compliance and improve user experience. Many Kenyans have previously failed to file tax returns due to the cumbersome processes on iTax.

“This is a move to centralise digital services in government,” KRA said. “We are aligning with the government’s plan to make eCitizen the single access point for all public services.”

Currently, only Nil returns can be filed via eCitizen. KRA has hinted at expanding the services to include more tax categories in the near future.

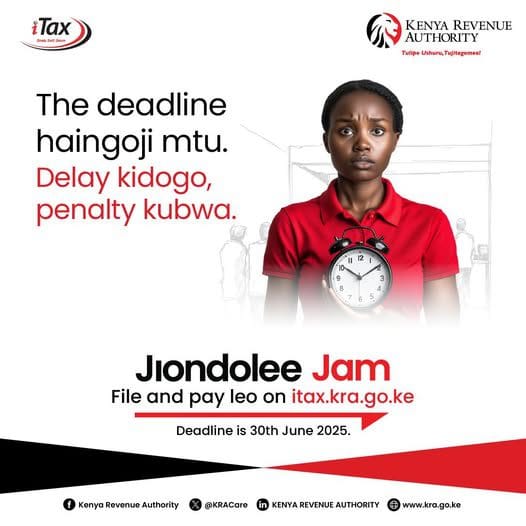

Kenyans are reminded that the deadline for filing tax returns remains June 30, and failure to comply may result in penalties. KRA is encouraging taxpayers—especially those without income—to take advantage of the simplified platform and avoid the end-month rush.